Whether you’re a financial professional or an investor, analyzing financial statement information is crucial. But there are so many different numbers that it can seem cumbersome and very intimidating to wade through it all. But if you know what some of the more important figures on these statements are—like financial ratios—you’ll probably be on the right track. Public companies such as General Electric and Disney publicly issue financial statements to report their financial performance and condition. These can be obtained directly from the company website, third-party financial websites such as CNBC or from the Securities and Exchange Commission.

Operating Expense Ratio Formula in Excel (with excel template)

(!) Remember, SalesNash specializes in lead generation and appointment setting, offering an effective solution for outsourcing outbound efforts. This can help you keep your expense to revenue ratio low while reducing CPL and CPA. ✔ Now, mastering this ratio is the secret sauce for unlocking higher profits, financial stability, and the power to make bold business moves. Again, it’s all an ongoing process that requires regular monitoring and adjustments to ensure long-term financial efficiency and profitability. The price-earnings, or P/E ratio, is calculated by taking market value per share divided by earnings per share. This is one of the most widely used stock valuations and generally shows how much investors pay per dollar of earnings.

Gross Margin

It reveals how efficiently a business is utilizing its resources and controlling expenses in relation to the revenue generated. As we mentioned above, a lower expense to revenue ratio indicates that a company is effectively managing its costs, maximizing profitability by keeping expenses in check. This translates to higher profit margins and improved financial stability. The cost of sales to revenue ratio plays a significant role in the determination of profit margins. Suppose a company’s cost of sales to revenue ratio is too high, which means that production costs are eating up a significant amount of its revenue.

Types of Profitability Ratios

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. Margin ratios give insight, from several different angles, into a company’s ability to turn sales into profit. Return ratios offer several different ways to examine how well a company generates a return for its shareholders using the money they’ve invested.

It can indicate whether company management is generating enough profit from its sales and keeping all costs under control. A company with a high pretax profit margin compared to its peers can be considered a financially healthy company with the ability to price its products and/or services most appropriately. A company’s profitability ratios are most useful when compared to those of similar companies, the company’s own performance history, or average ratios for the company’s industry. Normally, a higher value relative to previous value indicates that the company is doing well.

What are some strategies for minimizing expense ratios in an investment portfolio?

This data should be related to the same time period as the operating expense. ✔ The expense to revenue ratio is like your financial GPS, do i have to file taxes in multiple states guiding businesses on the path to profitability. It’s all about how well you handle expenses compared to the revenue you bring in.

- It suggests that the company may have inefficient cost management practices or may be incurring excessive expenses.

- Mutual funds pool money from multiple investors to invest in a diverse range of assets.

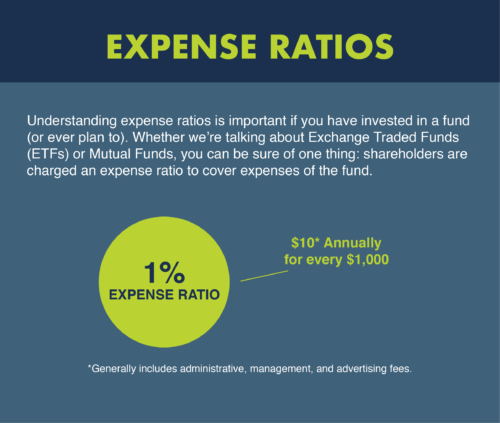

- Thus, if a company has $9 in total costs for every $10 in total sales, it has a 90 percent expense ratio.

- By utilizing effective strategies and technology, businesses can strike the right balance between production costs and revenue to achieve optimal performance.

Our unique B2B lead generation strategies allow your business to streamline its sales processes. Therefore, you can easily align costs and revenues with your set goals and budget parameters. A higher CRR percentage suggests that more revenue is being spent on costs. It can impact profitability unless your company can scale its revenue effectively to offset these costs. While a lower expense ratio can contribute to higher returns, it is also essential to consider other factors that influence an investment’s performance.

The use of ELNs to implement the covered call strategy also caps the upside potential of the ETF, making it less suitable for those primarily seeking capital appreciation. This JPMorgan ETF might be an attractive option for investors seeking income while maintaining exposure to the tech-heavy Nasdaq-100. The active management component focuses on identifying undervalued stocks or those with lower volatility, while also considering environmental, social, and governance (ESG) factors. This ETF targets stocks from the Nasdaq-100, focusing on technology and growth sectors, but with the discretion to select stocks outside the index if they meet the fund’s criteria. This ETF is fairly complex and tailored for advanced investors, so here’s what you need to know before considering an investment. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

If you can’t see a way to increase revenue, you’ll likely look for ways to cut costs. Reducing costs too much might lead to defective products, rush jobs, and a lack of expertise. In retail, your costs are generally divided into fixed and variable costs. Fixed costs are things like rent and salaries, which typically stay the same for long periods. Variable costs change with your sales volume and might include utilities and inventory.

The premiums collected from these calls are a key source of the fund’s income, enhancing its yield. This method aims to provide regular income to investors through option premiums, but can cap upside returns. Experts recommend finding low-cost funds so you don’t lose big bucks to fees over the course of a career. And it’s not just the direct fees; you’re also losing the compounding value of those funds. Profitability ratios can shed light on how well a company’s management is operating a business. Investors can use them, along with other research, to determine whether or not a company might be a good investment.