Similarly, a relatively low ratio would be considered a good sign as the company’s expenses are less than that of its revenue. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

- The debt-to-equity (D/E) ratio is the best way to calculate your business’s solvency.

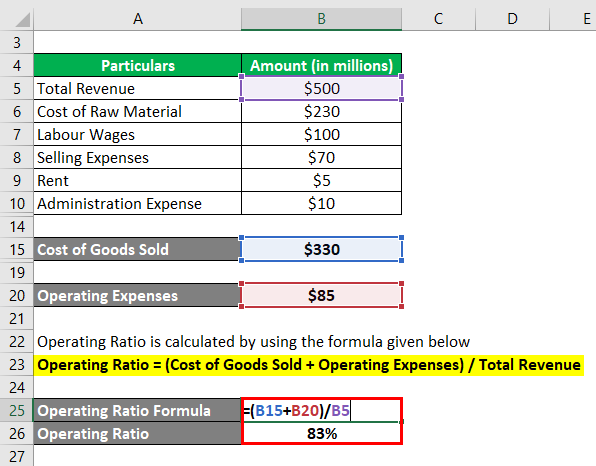

- It is calculated by dividing a company’s operating expenses by its net sales or revenue.

- However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

- The following steps are to be undertaken to calculate the operating ratio in case the operating expenses include the cost of goods sold.

Operating Margin: What It Is and the Formula for Calculating It, With Examples

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

Shortcomings of the Operating Ratio Metric

Otherwise, growth could lead to inefficiencies that actually worsen the operating Ratio. Direct labor refers to workers directly involved in producing a company’s goods or services, whose wages are closely watched by analysts to gauge impacts on operating ratios and stock prices. Dividing operating expenses by assets rather than revenue measures capital intensity or how efficiently a firm uses assets to drive revenue. Since the operating Ratio reflects operational decisions under management’s control, it serves as a scorecard for management execution. Skillful managers find ways to smoothly run operations, while inept managers allow expenses to balloon. It is crucial to compare businesses within the same industry when utilizing operating ratios because permissible ratios might differ significantly between industries.

How Is Operating Margin Different From Other Profit Margin Measures?

Some use simple measures in their numerators and denominators, such as COGS (Cost of Goods Sold) and revenue, but many incorporate other ratios into the calculation. Therefore, it is crucial to have a firm grasp on the most basic ratios, such as working capital. Like all ratios, these are only meaningful when compared across time, and to the industry norm. The what is unearned revenue top faqs on unearned revenue for Apple means that 72% of the company’s net sales are operating expenses. Apple’s operating ratio must be examined over several quarters to get a sense of whether the company is managing its operating costs effectively.

Operating Profit Ratio

Analysts use operating ratios to evaluate and compare the operational efficiency and profitability of companies within the same industry. The operating Ratio provides insights into how well a company manages costs and utilizes its resources to generate profits. The term operating ratio refers to the efficiency of a company’s management by comparing the total operating expense (OPEX) of a company to net sales. The operating ratio shows how efficient a company’s management is at keeping costs low while generating revenue or sales. The smaller the ratio, the more efficient the company is at generating revenue vs. total expenses. Trends in the operating Ratio over time provide insight into management’s ability to manage expenses.

What is the Operating Ratio Formula?

The debt-to-equity (D/E) ratio is the best way to calculate your business’s solvency. To get this metric, divide your total liabilities by your total equity. The operating expenses component include administration expenses along with selling and distribution expenses. Weigh capital expenditure trends relative to changes in the operating Ratio.

The operating expense ratio (OER) is used in the real estate industry and is a measurement of what it costs to operate a property compared to the income that the property generates. It is calculated by dividing a property’s operating expense (minus depreciation) by its gross operating income. The operating ratio is a measure of efficiency that is used by management to determine day-to-day operational performance. This metric compares operating expenses, also known as OPEX, to net sales.

It shows the company is operationally efficient and converting a higher portion of revenues into profits over time. Multi-period trends in operating ratios help determine ideal investment entry and exit points. For example, an elevated ratio sometimes signals a stock is overvalued and set to decline, prompting an investor to delay purchase. On the other hand, the operating ratio is the comparison of a company’s total expenses compared to the revenue or net sales generated. The operating ratio is used for company analysis in various industries while the OER is used in the real estate industry.

For stock investors, a decreasing operating ratio is very positive news. With a greater share of revenues flowing through to the bottom line, earnings get a consistent boost. It relies on the accuracy of a company’s financial reporting, and variations in accounting methods distort comparisons between firms. Business factors like economies of scale or regulatory costs that are outside management’s control also influence the Ratio.