Otherwise, you’d be asked to add more funds in a margin name. Therefore the amount that you simply want as your overall margin is continually altering as the value of your trades rises and falls. You ought to always have no less than 100% of your potential losses coated by your overall margin. In addition to your required margin you would wish to have a sufficient total margin balance in your account. These are the funds in your account that are not getting used to trade. They present cover for the chance of your commerce going in opposition to you.

So, while it may be a really lucrative method to commerce, it can also plunge you deep into the pink if not managed properly. While not unlawful, these flagged as sample merchants should show they’ve the capital to cover their risks and maintain enough accessible money of their buying and selling steadiness. Margin buying and selling entails opening a place using a deposit that represents a fraction of the full worth of the commerce.

Are You Able To Lose Your Whole Money On Margin?

On the opposite hand, ought to security values decline, an investor may be confronted owing more cash than what they provided as collateral. When faced with a margin name, traders usually need to deposit additional cash into their account, sometimes by selling other securities. If the investor refuses to do so, the broker has the right to forcefully promote the investor’s positions to have the ability to elevate the necessary funds. Many investors fear margin calls as a result of they will drive buyers to sell positions at unfavorable prices. Here’s the deal, whenever you get your self into debt to take a position, you’re leaving your self weak to monetary disaster and it’s just not worth it.

It’s calculated primarily based on the present closing worth of open positions multiplied by the variety of contracts and leverage. Such funds are known as a margin loan, and you should use them to purchase additional securities or even for short-term wants not associated to investing. Because you set up 50% of the acquisition price, this implies you have $20,000 worth of buying power. Then, when you purchase $5,000 value of inventory, you still have $15,000 in shopping for power remaining. You have enough money to cowl this transaction and haven’t tapped into your margin.

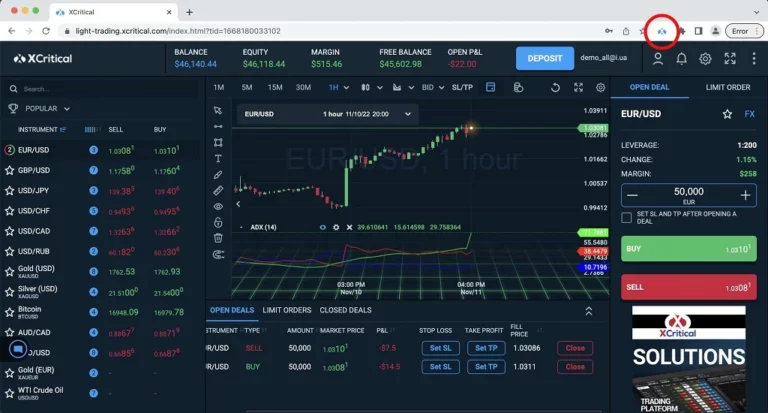

What’s The Difference Between Margin And Leverage?

You can now check the margin requirements, select a position size, apply any risk management parameters similar to a cease loss order, and place your commerce. If you don’t meet the required margin in the allotted time, the brokerage might routinely liquidate your positions. The maintenance margin refers to the amount of money you need in your account to cover the current value of the place together with any losses. If the inventory dropped and you offered it for $45 per share, you’d realize a lack of 20%—double what the loss can be when you paid for the stock totally in cash. And do not forget, the entire time you’re holding a margin loan stability, you are incurring curiosity on that amount.

This means that when a commerce goes against you, it can mechanically be closed before any losses develop too massive and result in the risk of a margin name. When you obtain a margin call, you ought to not ignore it and do nothing. This may result https://www.xcritical.com/ in a margin closeout, where your dealer closes your trades and also you danger losing everything. The cash you want to open a position is your required margin. It’s defined by the amount of leverage you are utilizing, which is represented in a leverage ratio.

Components Of Margin Trading

It could be worth considering these before you resolve if buying and selling on margin is best for you. Brokerage customers who signal a margin agreement can generally borrow up to 50% of the acquisition price of latest marginable investments (the exact amount varies relying on the investment). As we’ll see beneath, that means an investor who makes use of margin could theoretically buy double the amount of stocks than in the occasion that they’d used money solely. Most traders borrow lower than that because—the more you borrow, the extra threat you take on—not to mention the interest costs you will need to pay—but 50% makes for simple examples.

Examples are hypothetical, and we encourage you to seek personalized recommendation from certified professionals relating to particular investment issues. Our estimates are primarily based on previous market efficiency, and previous efficiency isn’t a assure of future efficiency. The portion of the acquisition worth that you simply pay depends on the safety. To learn extra, see Eligible Securities and Applicable Margin. You can still open an account at TD Ameritrade and we’ll let you realize when your account is ready to be moved. This article supplies basic pointers about investing topics.

Utilizing Margin

But you could lose your principal and then some if your shares go down too much. However, used wisely and prudently, a margin loan is normally a useful tool in the right circumstances. So, assume you own $5,000 in stock and buy an extra $5,000 on margin. Your fairness in the place is $5,000 ($10,000 much less $5,000 in margin debt), giving you an equity ratio of 50%.

The margin account and the securities held inside it are used as collateral for the mortgage. And whereas you must pay back the amount you borrowed, plus interest, your account gets to keep any funding earnings generated with the borrowed money. The reason is that the paper profits in the account result in excess margin, extra fairness in the account than essential.

How Does Margin Trading Work?

This group oversees margin buying and selling by writing and imposing guidelines that govern the business, making certain brokerage firms’ compliance with those guidelines, and educating investors. FINRA’s objective is to help protect investors and regulate brokerages to guarantee that they’re working in the most effective interests of American traders. This is the sort of brokerage account you’ll need to start trading on margin. It means the brokerage agency will lend funds for inventory purchases. When you buy on margin, you’re purchasing property utilizing money that you borrow out of your dealer.

- Exchanges or other regulatory our bodies set the minimal margin requirements, although sure brokers may improve these margin necessities.

- In a general enterprise context, the margin is the difference between a product or service’s selling price and the value of production, or the ratio of revenue to revenue.

- If a $50,000 inventory investment grows by 10%, your revenue shall be $5,000 regardless of whether you got that stock with money solely or a combination of money and margin.

- As a result, if the shares fall, your equity in the place relative to the scale of your margin debt will shrink.

- The “call” is a request for the investor to satisfy the maintenance margin and usually occurs when a safety the investor bought decreases in worth.

You cannot fully commerce on margin inside an IRA as these are thought-about money accounts. Some brokers, nonetheless, will enable clients to apply for “limited margin,” which allows them to buy securities with unsettled money. Mutual funds usually are not obtainable for margin buying and selling, since their costs are set just as soon as a day. While it could seem that margin buying and selling means larger earnings, that’s not technically true. If a $50,000 inventory investment grows by 10%, your revenue shall be $5,000 regardless of whether or not you got that inventory with money only or a combination of cash and margin.

If the entire worth of your stock position falls to $6,000, your fairness would drop to $1,000 ($6,000 in stock much less $5,000 margin debt) for an fairness ratio of less than 17%. If the inventory had fallen even additional, you can theoretically lose your whole preliminary investment and nonetheless should repay the amount you borrowed, plus interest. Miss the margin call deadline, and the dealer will decide which stocks or different investments to liquidate to convey the account in line. It should due to this fact be used only by buyers who absolutely understand its operation and respect its pitfalls. If you can’t promptly meet the margin name, your broker has the proper to promote some of your securities to deliver your account back as a lot as the margin minimal. What’s extra, your dealer doesn’t want your consent to promote your securities.

If you’re trying to day commerce, this dollar figure goes up to $25,000 in accordance with FINRA guidelines. This is the minimal margin when opening a margin buying and selling account. A margin call occurs when the worth of an investor’s margin account dips under the brokerage’s upkeep margin. The “call” is a request for the investor to meet the upkeep margin and normally occurs when a safety the investor purchased Spot vs Margin Crypto Trading decreases in value. If you get a margin name, you may convey the account up to the minimal amount by depositing more funds, or assets, into the account, or promoting off some securities within the account. If traders primarily enter into margin buying and selling to amplify positive aspects, they must be aware that margin trading also amplifies losses.

Unlike margin on stocks or portfolio margin, margin on futures and forex trading isn’t a mortgage. To open a futures place, you should provide a deposit (sometimes called a great religion deposit). The amount of the deposit is the “preliminary margin” required to open the position. The required margin after opening the position is called the “maintenance margin” degree. If the account’s available funds fall under the upkeep stage, the account would be in a margin call, and you’d be required to add more funds instantly.