It ensures that a portion of bank deposits is invested in liquid assets that can readily be converted into cash to meet any repayment obligations. The statutory liquidity ratio is an essential tool in the RBI’s arsenal to control inflation and prop up the Indian rupee. Adequate liquidity shows a company has the means to pursue opportunities, invest in growth, and manage unforeseen cash needs. Illiquid firms have little margin for error and lack capital to fund expansion, R&D, marketing, and other initiatives that enhance shareholder value. Comparing liquidity between industry peers reveals which companies have greater flexibility.

Quick liquidity ratio

Except as specified in relation to shares and units in CIUs in points (b) and (c) of Article 15(2), no haircut shall be required on the value of the remaining level 1 assets. Chapter 2 of the Liquidity Coverage Ratio (CRR) Part of the PRA Rulebook lays down rules to specify in detail the liquidity coverage requirement provided for in Article 412(1) of CRR. This is a very important criterion that creditors check before offering short term loans to the business. An organisation which is unable to clear dues results in creating impact on the creditworthiness and also affects credit rating of the company.

Example of Using Liquidity Ratios

This 100% outflow rate shall apply to the maturing amount or to the amount of assets that could potentially be returned or the liquidity required. Limitations shall be placed such that those instruments cannot be bought and held by parties other than retail customers. An outflow rate of 100% shall be applied to cancelled deposits with a residual maturity of less than 30 calendar days and where pay-out has been agreed to another credit institution. The outflows referred to in paragraph 1 shall be assessed under the assumption of a combined idiosyncratic and market-wide stress as referred to in Article 5. For that assessment, credit institutions shall take particular account of material reputational damage that could result from not providing liquidity support to such products or services. Credit institutions shall have policies and limits in place to ensure that the holdings of liquid assets comprising their liquidity buffer remain appropriately diversified at all times.

Which of these is most important for your financial advisor to have?

It is the minimum percentage of the deposit that a commercial bank needs to maintain in the form of cash, securities and gold before offering credit to customers. In order to gain a deeper understanding of liquidity ratios and their implications on your investments, consider consulting with a financial advisor for expert guidance. The cash ratio varies between industries because some sectors rely more heavily on short-term debt and financing such as those that rely on quick inventory turnover. However, it’s important for small businesses to balance liquidity with efficiency. Excessive liquidity might mean that resources are not being utilized effectively for growth opportunities.

What is your current financial priority?

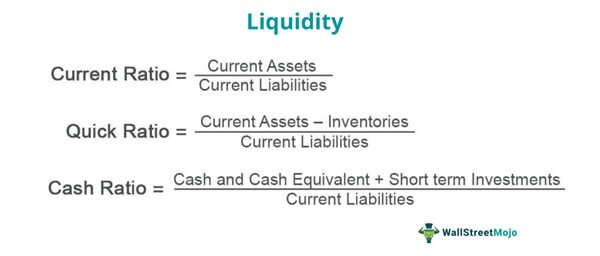

- For example, suppose a company has Rs.50,000 in cash, Rs.20,000 in T-bills, and Rs.100,000 in accounts payable; its cash ratio would be as given below.

- As a result of this software, they are able to remain on top of their client’s requirements by monitoring a timely delivery.

- It represents the firm’s cash and cash equivalents divided by current liabilities and is a more conservative look at a firm’s liquidity than the current or quick ratios.

- Since liquidity measures surplus cash after near-term obligations, it directly impacts how much cash flow remains for activities that benefit shareholders, like dividends, buybacks, capex, acquisitions, R&D, and new products.

- They are widely used for this purpose and for deciding about financing mix, capital structure, investment, etc.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. If the Current Ratio is greater than 1.0, then Net Working Capital will be positive since Current Assets will be greater than Current Liabilities.

A high debt-to-equity ratio indicates the brokerage has a risky amount of debt relative to its equity capital. The interest coverage ratio measures how easily a brokerage service receives its interest costs from operating income. Liquidity and solvency ratios are two important classes of financial ratios used to assess the health and stability of companies, especially financial institutions like brokerages. While liquidity ratios evaluate the short-term financial situation, solvency ratios evaluate the longer-term financial sustainability and risks. Originally, the RBI set the SLR at a high level of 38.5% of a bank’s total demand and time liabilities. This meant banks had to invest over a third of their deposits into approved government securities and other liquid assets.

Different industries have varying liquidity requirements, and comparing companies across industries using liquidity ratios may not provide accurate results. Analysts must consider industry-specific norms when interpreting debits and credits in accounting examples these ratios. A company has more cash on hand, lower short-term liabilities, or a combination of the two. It also means a company will have a greater ability to pay off current debts as they come due.

A company may maintain high liquidity ratios by holding excess cash or highly liquid assets, which could be more effectively deployed elsewhere to generate returns for shareholders. In addition, a company could have a great liquidity ratio but be unprofitable and lose money each year. Where the short position is covered by a collateralised securities financing transaction, the credit institution shall assume the short position will be maintained throughout the 30 calendar day period and will receive a 0% outflow.

Low liquidity means a company could struggle to pay employees, creditors, suppliers, and other short-term liabilities. Comparing liquidity metrics to historical averages and industry benchmarks highlights improving or worsening trends. Deteriorating ratios over time or versus competitors suggest heightened financial risks that warrant caution. By calculating the various liquidity ratios as in the example above, the cash situation of the company can be analysed. This means that the company has more current assets available than it has short-term liabilities to service – a positive sign. Liquidity Ratios measure a company’s ability to meet its short-term financial obligations.