LIFO reserve is an accounting term that measures the difference between the first in, first out (FIFO) and last in, first out (LIFO) cost of inventory for bookkeeping purposes. The LIFO reserve is an account used to bridge the gap between FIFO and LIFO costs when a company uses the FIFO method to track its inventory but reports under the LIFO method in the preparation of its financial statements. To provide clarity for financial statement users, companies must clearly disclose the dollar value of the LIFO reserve as a separate line item on the balance sheet. The LIFO reserve balance should also be explained in footnotes with details on its calculation and changes from year to year. Separation and transparency regarding the LIFO reserve contribution to earnings allows shareholders, lenders, and other stakeholders to better understand inventory-related expenses and cash flows. Explicit reporting of the LIFO reserve as its own distinct component improves financial statement interpretability.

LIFO Reserve Formulas

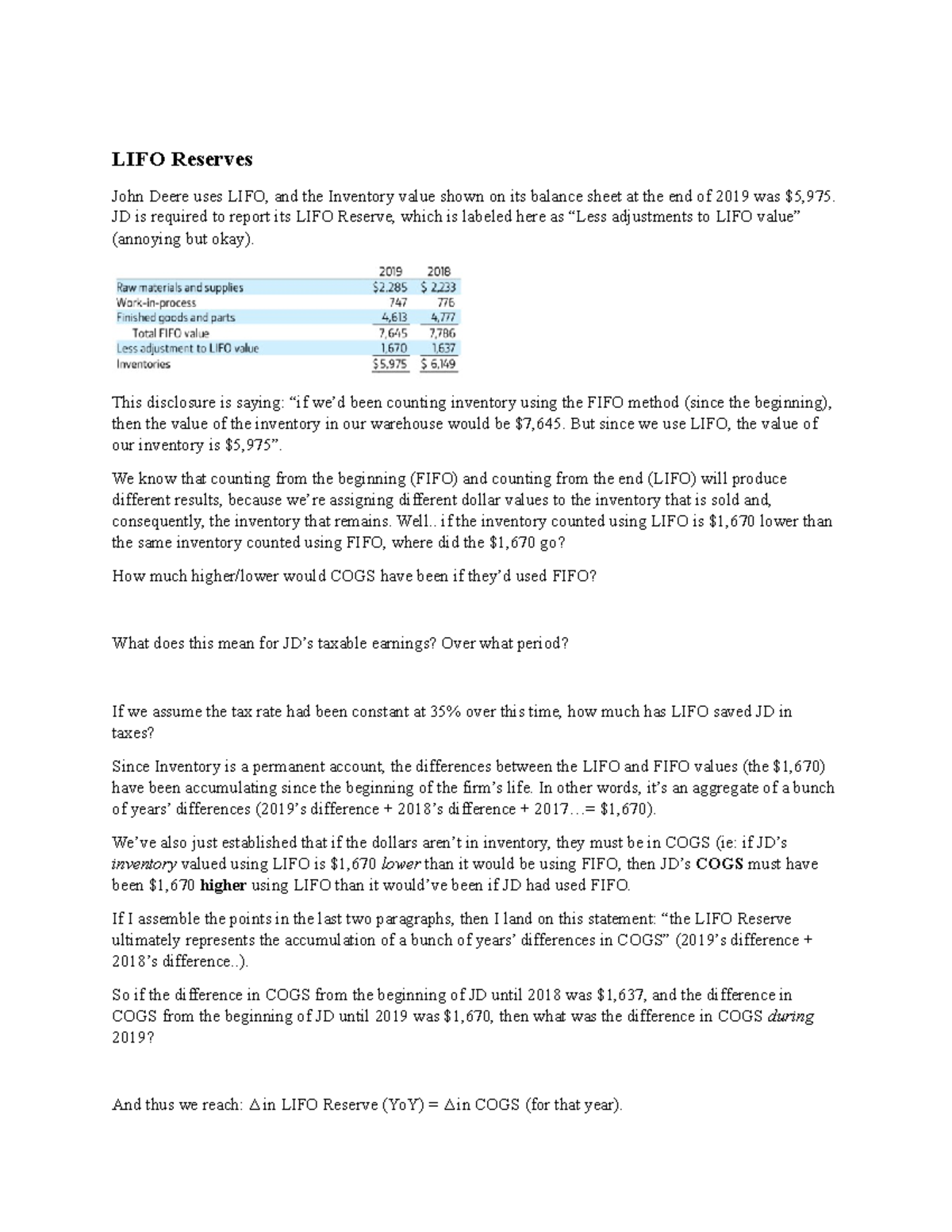

There are two main inventory valuation methods in accordance with generally accepted accounting principles (GAAP), LIFO and FIFO. It is common for companies to use the FIFO method to manage their inventory internally, while leveraging the LIFO method for financial statement presentation and tax purposes. The absorption costing vs variable costing: what’s the difference is an account used to reconcile the difference between the FIFO and LIFO methods of inventory valuation. This difference arises when a business is using the FIFO method as part of its accounting system but is using the LIFO method to report in its financial statements. For example, when using the LIFO method for inventory accounting in periods of rising prices, the cost of reported inventory is higher than the FIFO method, which, therefore, increases a company’s cost of goods sold (COGS), decreasing its pre-tax earnings. When pre-tax earnings are lower, there is a lower amount to pay taxes on, thus, fewer taxes paid overall.

Find the talent you need to grow your business

It enables accurate reporting of inventory value to shareholders based on Generally Accepted Accounting Principles (GAAP). During periods of rising inventory unit costs, inventory carrying amounts under the FIFO method will exceed inventory carrying amounts under the LIFO method. The LIFO reserve may also increase over time as a result of the increasing difference between the older costs that are used to value inventory under LIFO and the more current costs that are used to value inventory under FIFO. Additionally, when the number of inventory units manufactured or purchased exceeds the number of units sold, the LIFO reserve may increase due to the addition of new LIFO layers. The primary purpose of using two different valuation methods (LIFO and FIFO), is to prepare internal and external financial reports in the most advantageous way possible.

- The objective of using LIFO for external purposes is the inflationary economic conditions resulting in higher inventory costs.

- Tracking inventory levels and market cost changes allows for better planning around liquidations.

- This increase in gross profits will occur because of the lower inventory carrying amounts of the liquidated units.

- When the external stakeholders are analyzing the company’s financial health and position in the market, they mainly rely on the financial ratio analysis.

Adjusting the Financial Statements

The most important benefit is that it allows a comparison between LIFO and FIFO and the ability to understand any differences, including how taxes might be impacted. Both methods have different impacts on the financial performance reporting and financial ratios of companies. If a company uses a LIFO valuation when it files taxes, it must also use LIFO when it reports financial results to its shareholders, which lowers its net income. Taxpayers experiencing rising inventory costs should consider adopting the LIFO cost-flow method.

LIFO Liquidation

Includes early redemption premium and the write-off of certain pre-existing debt issuance costs. The ratio of Net Debt to Adjusted EBITDA was 2.8x at the end of the third quarter of fiscal year 2024, compared to 2.8x at the end of fiscal year 2023 and 2.9x at the end of the third quarter of fiscal year 2023. You will notice that in the ninth month, we only calculated 4000 cartons because not the whole 5,500 cartons made were sold. It is important to review disclosures on LIFO reserves to determine if LIFO liquidation has occurred. A decline in the LIFO reserve from a prior period may indicate that LIFO liquidation has occurred. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Without the LIFO reserve, financial statements would be less accurate and comparable between companies using different inventory methods. The reserve provides transparency for shareholders into the true valuation of inventory. If inventory unit costs rise and LIFO liquidation occurs, an inventory-related increase in gross profits will be realized.

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. When the company provides this reserve, we can easily calculate FIFO inventory using the below formula. The following are the different steps of the calculation of LIFO reserve accounting used in finding out the reserve value for the business. Accounting professionals have discouraged the use of the word “reserve,” encouraging accountants to use other terms like “revaluation to LIFO,” “excess of FIFO over LIFO cost,” or “LIFO allowance.” A supplemental quarterly earnings presentation will also be available on the Company’s website at spartannash.com/investor-presentations.

Company ABC used the LIFO method, whereas another competitor company used the FIFO method for inventory valuation. The current ratios of both companies cannot be compared due to this difference in reporting. Most companies use the LIFO method for external reporting due to the tax savings and the non-LIFO method for internal reporting. As a result, a reserve of the difference between LIFO inventory cost and non-LIFO inventory cost. This information is dependent upon future events, which may be outside of the Company’s control and could have a significant impact on its GAAP financial results for fiscal 2024.

Net income was $148 million, an increase of $53 million compared to the prior year. Net income margin was 1.5%, an increase of 48 basis points compared to the prior year. Adjusted EBITDA was $455 million, an increase of $53 million or 13.2%, compared to the prior year. Adjusted EBITDA margin was 4.7%, an increase of 27 basis points compared to the prior year. Net sales of $9.7 billion for the quarter increased 6.8% from the prior year, driven by total case volume growth and food cost inflation of 3.2%. Total case volume increased 3.8% from the prior year driven by a 4.1% increase in independent restaurant case volume, a 5.7% increase in healthcare volume, a 3.0% increase in hospitality volume and a 2.4% increase in chain volume.