By recording each customer’s credit sales in the journal, businesses can easily see who owes them money and how much. By using a receipt maker, businesses can save time and effort while ensuring that their credit sales are accurately recorded and communicated to customers. Credit sales refer to a sale in which the amount owed will be paid at a later date.

Facilitating Financial Audits

Credit sales are transactional agreements between buyers and sellers, whereby the buyer purchases goods and services and agrees to pay the seller at a later date. If the person who records the transaction makes a mistake, the incorrect deal will appear in the company’s books of accounts. It helps record the transaction involving the sale of goods on credit by the company appropriately, keeping track of every credit sale involved. Accrued revenue refers to a company’s revenue that has been earned through a sale that has already occurred, but the cash has not yet been received from the paying customer. The cash has been paid by the customer – in other words, our bank account has increased. As the cash account is an asset, we would increase this by debiting that account.

Types of Sales Transactions

This means that businesses need to track both Accounts Receivable and Accounts Payable to correctly record revenue and expenses. When companies offer goods or services to their customers on credit, it is termed credit sales. Credit sales refer to sales that are not paid for immediately upon purchase. The customer who owes the company for the good or service is called a debtor while the amount owed is considered a current asset called an account receivable.

Benefits of making credit sales journal entries

Typically, an accountant will record adjustments for accrued revenues through debit and credit journal entries in defined accounting periods. This helps account for accrued revenues accurately and so that the balance sheet remains in balance. A credit sales journal entry is a type of bookkeeping transaction used to record the sale of goods or services on credit. The journal entry includes a debit to the Accounts Receivable and a credit to the Sales account.

How To Record a Credit Sale

It means John Electronics must make the payment on or before January 30, 2018. Credit sales boost the buyer’s inventory and also give them enough credit sales journal entry time to sell the product and repay their supplier. This credit period is usually decided well in advance and can vary from industry to industry.

This can lead to a situation where the business has to wait for a long time before it can receive the money from the customer, which can lead to cash flow problems. Businesses must manage their cash flow carefully when utilizing credit sales in order to ensure they remain profitable. This is because cash flow problems can cause businesses to face a number of issues, including not having enough money to pay employees, pay vendors or purchase new inventory. Additionally, cash flow problems can lead to a business not being able to pay its bills on time, leading to a negative credit rating.

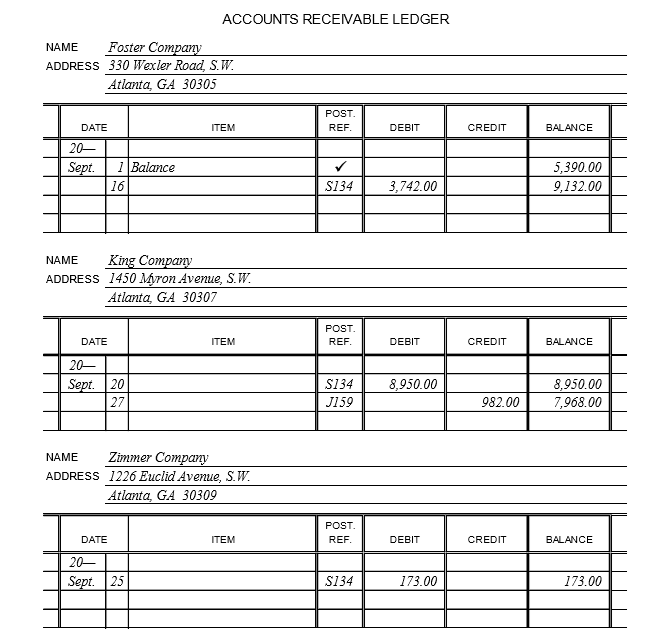

In the above example, 400 is posted to the ledger account of customer BCD, 150 to customer KLM, and 350 to customer PQR. When posting to the accounts receivable ledger, a reference to the relevant page of the journal would be included. When all credit sales are properly recorded in the journal, it minimizes the chances of errors when entering the information into your accounting software. Credit sales involve a risk that the buyer might not eventually pay when the amount is due. This results in bad debts expense, which is estimated based on the creditworthiness of the buyer and the company’s past experience.

- Each of these three types of sales transactions has their own advantages and disadvantages.

- When a business sells products or services on credit, it creates a sales journal entry.

- As the cash account is an asset, we would increase this by debiting that account.

- Welcome to AccountingFounder.com, your go-to source for accounting and financial tips.

- The Accounts Receivable account is an asset, as it represents a future economic benefit that is expected to be received by the company.

Accrued revenue normally arises when a company offers net payment terms to its clients or consumers. In this scenario, if a company offers net-30 payment terms to all of its clients, a client can decide to purchase an item on April 1; however, they would not be required to pay for the item until May 1. For example, if the item costs $100, for the entire month of April, the company would record accrued revenue of $100. Then, when May 1 rolls around and the payment is received, the company would then create an adjusting entry of $100 to account for the payment. In conclusion, credit sale is an important type of sale transaction for businesses.

When products are sold to a customer on credit, the account receivable is debited, which increases the company’s assets as money is eventually paid by the third party. Thus, unless settled, it results in the formation of assets for the company and is shown on the balance sheet. Sales are a part of everyday business, they can either be made in cash or credit. In a dynamic environment, credit sales are promoted to keep up with the cutting edge competition. Accounting and journal entry for credit sales include 2 accounts, debtor and sales. In case of a journal entry for cash sales, a cash account and sales account are used.

To record the sale, you would make a sales credit journal entry that includes a debit to Accounts Receivable and a credit to Sales. Sales credit journal entry refers to the journal entry recorded by the company in its sales journal when the company makes any sale of the inventory to a third party on credit. In this case, the debtor’s account or account receivable account is debited with the corresponding credit to the sales account.