This is because the actual price paid to buy 5,000 units of direct material exceeds the standard price. Direct material quantity variance is calculated to determine the efficiency of the production department in converting raw material to finished goods. A negative value of direct material quantity variance is generally unfavorable and it implies that more quantity of direct material has been used in the production process than actually needed.

Direct Materials Price Variance FAQs

This investigative approach ensures that corrective actions are targeted and effective. Direct materials actually cost $297,000, even though the standard cost of the direct materials is only $289,800. A material quantity variance is the difference between the actual amount of materials used in the production process and the amount that was expected to be used. The measurement is employed to determine the efficiency of a production process in converting raw materials into finished goods. Material quantity variance is favorable if the actual quantity of materials used in manufacturing during a period is lower than the standard quantity that was expected for that level of output.

Example of Direct Materials Quantity Variance Calculator

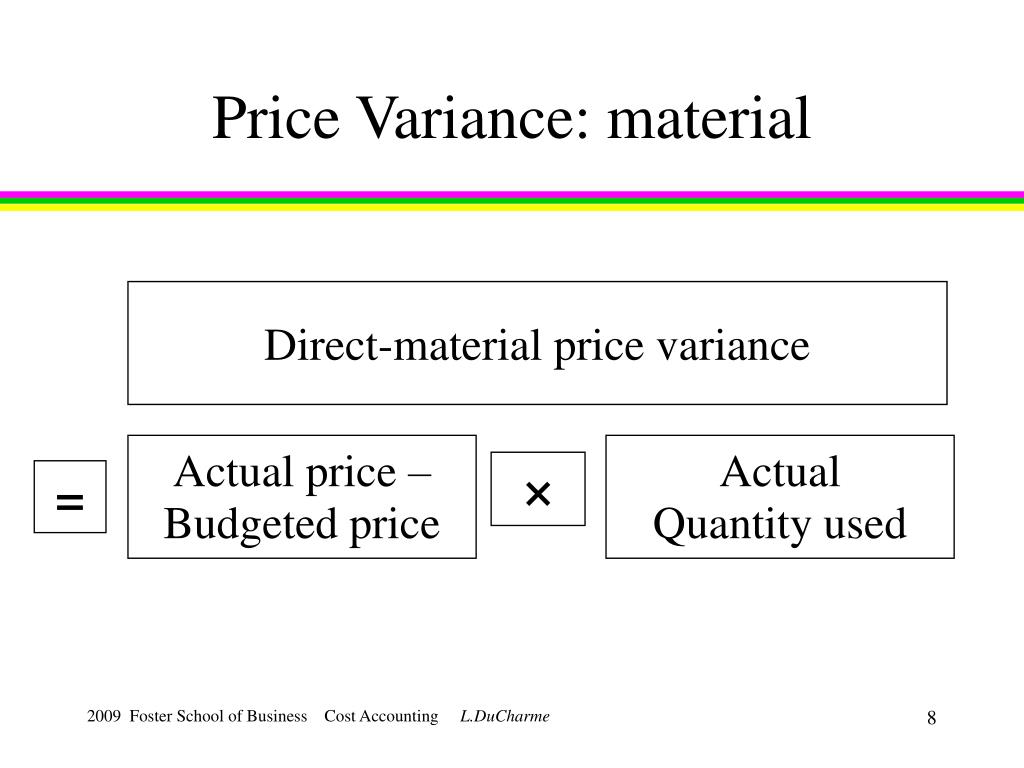

- This formula is critical for understanding how actual spending tracks against estimations.

- Using the materials-related information given below, calculate the material variances for XYZ company for the month of October.

- Direct materials price variance account is a contra account that is debited to record the difference between the standard price and actual price of purchase.

- This comparison helps businesses understand whether they are spending more or less than anticipated on raw materials.

As businesses strive for greater precision in cost management, advanced techniques in variance analysis have become increasingly valuable. One such technique is the use of trend analysis, which involves examining variance data over multiple periods to identify patterns and trends. By understanding these trends, companies can anticipate future variances and take proactive measures to mitigate them. Analyzing direct material variance is a powerful tool for businesses aiming to maintain cost control and enhance profitability. By delving into the specifics of variances, companies can uncover inefficiencies and make informed decisions to optimize their operations. The first step in this analysis is to regularly review variance reports, which provide a snapshot of how actual costs compare to standard costs.

Calculator for Direct Material Price Variance

This setup explains the unfavorable total direct materials variance of $7,200 — the company gains $13,500 by paying less for direct materials, but loses $20,700 by using more direct materials. Hence, the total material cost variance may result from the difference between the standard and actual quantities of materials used, the difference between the standard and actual prices paid for materials, tax form 1099 or from a combination of the two. The following equations summarize the calculations for direct materials cost variance. For purposes of inventory calculation, the direct materials account includes the cost of materials used rather than materials purchased. To calculate direct materials, add beginning direct materials to direct materials purchases and subtract ending direct materials.

How is direct material usage variance calculated in a multi-product company?

He has served in various leadership roles in the American Bar Association and as Great Lakes Area liaison with the IRS. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Direct Material Quantity Variance

If you’re looking for the PPV per unit, divide the total PPV by the number of units purchased by your business. To determine the total PPV for a specific order, subtract the standard amount from the actual amount. If feasible, at the end of every reporting period an analysis of purchase and production costs for capitalizability should be performed. You can calculate the standard quantity of materials by multiplying the standard quantity of materials per unit of output by the actual units of output produced in a given period.

It also helps identify inefficiencies within the supply chain or production process that may otherwise go unnoticed. Now that we have understood the direct material price variance calculation, let’s look at how to interpret it. Learn how to calculate, analyze, and apply direct material variance for effective cost control and improved financial performance. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. The material quantity variance is also known as the material usage variance and the material yield variance. Of course, variances can be caused by production snafus, such as an excessive amount of scrap while setting up a production run, or perhaps damage caused by mishandling.

Knowledge of this variance may prompt a company’s management team to increase product prices, use substitute materials, or find other offsetting sources of cost reduction. In a multi-product company, the total quantity variance is divided over each of the products manufactured. Lumber costs may rise due to increased fuel costs and then lower when diesel prices stabilize. In food service, the price of ingredients, such as milk and eggs, is always changing. When your business purchases others goods to produce your products, you must incorporate the cost of the supplies into your budgets at the beginning of the year and each month.

Conversely, a parsimonious standard allows little room for error, so there is more likely to be a considerable number of unfavorable variances over time. Thus, the standard used to derive the variance is more likely to cause a favorable or unfavorable variance than any actions taken by the production staff. Angro Limited, a single product American company, employs a proper standard costing system. The normal wastage and inefficiencies are taken into account while setting direct materials price and quantity standards.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.