Break times, such as lunch hours, are usually unpaid unless otherwise specified in the employment contract. On the other hand, actual hours represent the exact number of hours an employee works during a period, which may vary due to overtime, holiday, sickness, or other factors. While this sounds ideal, it’s important to remember that these impromptu scheduling decisions must be done with tact and respect — especially when Fair Workweek laws come into play.

Improving Organizational Productivity:

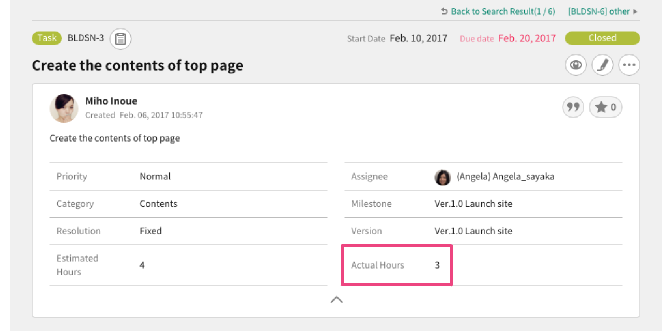

In the wake of the great resignation, restaurants have been raising labor costs to both attract and retain all-star employees. Nowadays, an over-staffed shift costs more because your restaurant could be seriously overspending on labor. So OKRs, being a popular goal management methodology, helps you to advance your goal management strategy and helps your team develop with confidence and skill in your goals. Instead of getting caught up in tasks with no interest, try to use your time wisely. Ensure planned hours for completing a task or goal and the actual hours match up more and more as you develop as a company. Aim for success, and keep yourself and your team motivated by effectively managing time and constantly improving.

Great! The Financial Professional Will Get Back To You Soon.

Tracking and managing billable and non-billable hours is crucial for professional service agencies, such as consulting, creative, or software development companies. If you bill in the standard 6-minute increments, using a billable hours conversion chart like the one below is quite helpful. These charts break down minutes into tenths of an hour, so you can easily convert time to a decimal. If a professional cannot keep accurate records of their work hours, this can lead to billing complications. If a client disputes their bill, it may be difficult to prove that the professional worked the hours they claimed they did. The functionality makes it easy to understand where your time goes.

Multiplying by Your Billing Rate

This higher rate reflects the additional value you bring to clients. These rules are set to ensure transparency, fairness, and ethical billing practices among law firms across the U.S. Let the software handle the administrative lifting to maximize your billable utilization. Dedicate chunks of time with no meetings or distractions to grind through billable project work.

The standard direct labor rate was set at $5.60 per hour but the direct labor workers were actually paid at a rate of $5.40 per hour. Find the direct labor rate variance of Bright Company for the month of June. This determines how much an employee gets paid, including any overtime pay they earn. It also factors into calculating things like vacation time and other benefits. Implementing a robust time tracking system allows for accurate recording of actual hours worked. This aids in monitoring any deviations from contracted hours and managing overtime effectively.

- The first step in the process is to agree on billable tasks and rates with your client.

- This is why you should always compare your results against what you wanted to achieve in the first place, to determine what needs to be changed.

- One of our clients manages cross-docking operations for one of the nation’s largest retailers.

Improve your team management

For example, a marketing agency that creates campaign strategies or analyzes marketing data for client projects would count these hours as billable. Tracking your billable and actual hours can tell you a lot about your agency’s performance, profitability, and operational efficiency. One proven strategy for boosting billable hours without reducing service quality is using legal software like Bill4Time. Bill4Time’s robust time tracking features are designed to meet the unique needs of legal professionals, ensuring no billable minute is overlooked. Finally, multiplying the rounded decimal hours by your hourly rate determines the fee. For instance, if the billing rate is $300 per hour and the task duration is 48 minutes (0.8 hours), you would multiply $300 by 0.8 for a total of $240 earned.

You’ll be able to allocate work accordingly when you can see the time spent on billable hours. Effective tracking of attendance improves productivity and helps the business focus more on work that makes money as opposed to other overheads. Remember, a high use of billable hours means more work that makes money.

So, it’s important to track time correctly to make sure billing is correct. Understanding these things well can help businesses lower other work and improve their overall performance. Calculating billable hours by tenths (i.e., converting hours and minutes into decimal numbers) involves dividing an hour into six-minute increments, each representing 0.1 of an hour. Non-billable tasks include activities necessary for business operations but cannot be charged for, such as administrative tasks, internal meetings, and training. Unlike manual methods and spreadsheets, time trackers automate time tracking, reduce errors, and provide detailed insights into how your team works.

Billable hours are the time spent on tasks you can charge clients for, while actual hours include all the work done, billable or not. Actual hours include all the time you work, not just what you can bill. This broader category encompasses billable tasks plus additional non-billable activities (more on billable vs. non-billable hours in the next section). For example, if you spend 10 hours working one day, you will likely only spend a portion of that time on tasks you can bill to a client.

That’s why you need to track productivity and time spent on non-billable hours as well. Because even though the employer is not billing the client, but still the employer is paying the employees; therefore, non-billable hours should contribute to long-term growth of the company. Lawyers use billable hours to keep track of the time they spend working on different cases for clients.

how to lower your 2020 tax bill are also important for billing and making sure bills are correct. They can affect if an employee can get benefits and how much they get paid for overtime. Understanding the difference between billable and actual hours is important for various reasons. Likewise, it is crucial for billing practices and getting billing accuracy. This formula helps determine the amount of time you can actually bill clients over the course of a year and accurately account for all chargeable work. Toggl Track offers powerful reporting features that generate insights into the time spent on specific projects, tasks, and clients.