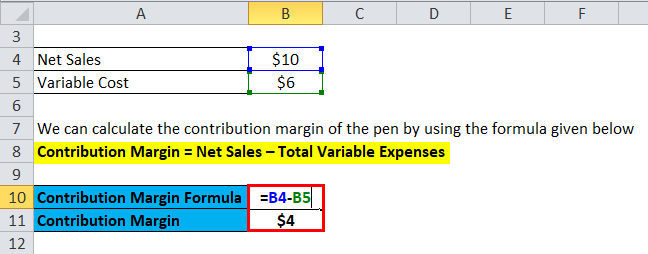

If not, the firm cannot produce that product or not enter that market segment. The contribution margin is the leftover revenue after variable costs have been covered and it is used to contribute to fixed costs. If the fixed costs have also been paid, the remaining revenue is profit. It means there’s more money for covering fixed costs and contributing to profit. You can calculate the contribution margin by subtracting the direct variable costs from the sales revenue.

Use of Contribution Margin Formula

They immerse themselves in historical data, searching for patterns that reveal how costs have responded to activity changes in the past. Some use statistical tools like regression analysis to quantify these relationships more precisely. The key is to focus on the relevant range of activity levels where cost behavior remains relatively stable and predictable. By doing so, executives and managers can make educated decisions that drive profitability and sustainable growth. The contribution margin helps to easily calculate the amount of revenues left over to cover fixed costs and earn profit. The contribution margin represents the revenue that a company gains by selling each additional unit of a product or good.

The Impacts of Fixed and Variable Costs

Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. Contribution margin ratio equals contribution margin per unit as a percentage of price or total contribution margin TCM expressed as a percentage of sales S. To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit. The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue. To stay competitive, they increasingly turn to sophisticated tools like cost behavior analysis and contribution margin calculations.

Understanding Cost Behavior

This direct relationship between activity level and cost gives businesses flexibility but also requires careful management to maintain profitability as production scales up or down. The concept of contribution margin melissa recently paid $625 for round is applicable at various levels of manufacturing, business segments, and products. However, an ideal contribution margin analysis will cover both fixed and variable cost and help the business calculate the breakeven.

A higher unit contribution margin indicates that a product is more profitable and contributes more towards covering fixed costs and generating profits. Conversely, a lower margin may signal the need to review costs, pricing strategies, or product offerings to improve profitability. The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost). If the selling price per unit is more than the variable cost, it will be a profitable venture otherwise it will result in loss. For small business owners, effectively using a contribution margin calculator means regularly updating it with accurate data. Keeping track of changes in variable costs or selling prices per unit is essential for the accuracy of the calculation.

AccountingTools

- If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers.

- However, this strategy only works within what financial analysts call the “relevant range” of production levels where these cost relationships hold true.

- You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce.

- Conversely, a lower margin may signal the need to review costs, pricing strategies, or product offerings to improve profitability.

In such cases, the price of the product should be adjusted for the offering to be economically viable. The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs.

A high margin means the profit portion remaining in the business is more. It may turn out to be negative if the variable cost is more that the revenue can cover. Contribution per unit is the residual profit left on the sale of one unit, after all variable expenses have been subtracted from the related revenue. This information is useful for determining the minimum possible price at which to sell a product. In essence, never go below a contribution per unit of zero; you would otherwise lose money with every sale. The only conceivable reason for selling at a price that generates a negative contribution margin is to deny a sale to a competitor.

The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. When only one product is being sold, the concept can also be used to estimate the number of units that must be sold so that a business as a whole can break even. For example, if a business has $10,000 of fixed costs and each unit sold generates a contribution margin of $5, the company must sell 2,000 units in order to break even. However, if there are many products with a variety of different contribution margins, this analysis can be quite difficult to perform. Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list.

The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis. Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. At the heart of every successful business lies the ability to understand and predict cost behavior, which refers to how expenses respond to variations in a company’s activity. A savvy production manager, for instance, uses cost behavior analysis to determine optimal production levels. A marketing executive might leverage this information to craft sales targets that align perfectly with the company’s financial goals.