The starting point is the determination of standards against which to compare actual results. Many companies produce variance reports, and the management responsible for the variances must explain any variances outside of a certain range. Some companies only require that unfavorable variances be explained, while many companies require both favorable and unfavorable variances to be explained. Usually, companies determine a specific level for variances above which they do not investigate any differences.

5: Describe How Companies Use Variance Analysis

The direct materials variances for NoTuggins are presented in Exhibit 8-4. Refer to the total direct materials variance in the top section of the template. Total standard quantity is calculated as standard quantity per unit times actual production or 4.2 feet of flat nylon cord per unit times 150,000 units produced equals 630,000 feet of flat nylon cord. Total direct material costs per the standard amounts allowed are the total standard quantity of 630,000 ft. times the standard price per foot of $0.50 equals $315,000.

List of 15 Variance Analysis and Variance Formula

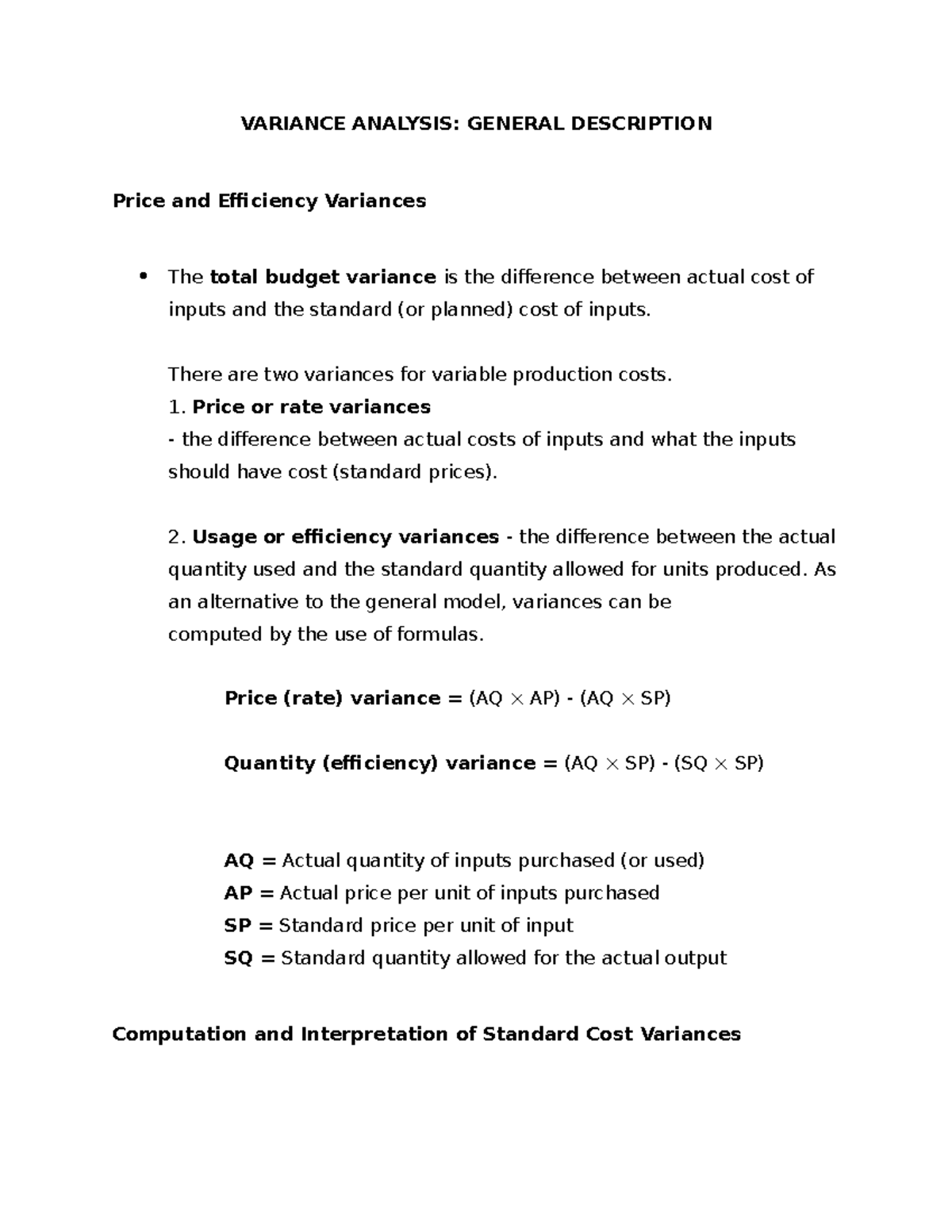

For fixed overheads, therefore, companies can calculate expenditure and volume variances. They can further classify volume variances into capacity and efficiency variances. Standard costs provide information that is useful in performance evaluation. Standard costs are compared to actual costs, and mathematical deviations between the two are termed variances. Favorable variances result when actual costs are less than standard costs, and vice versa. The following illustration is intended to demonstrate the very basic relationship between actual cost and standard cost.

Semi-Variable Cost – Definition, Formula, And How to calculate

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Using the standard and actual data given for Lastlock and the direct materials variance template, compute the direct materials variances. When using variance analysis, companies may come across positive or negative variances. Positive variances, also known as favorable variances, are when the differences are in the company’s favour. For example, an increase in sale prices can result in a favorable sales variance.

- As shown in Exbibit 8-1, Brad projects that the standard variable cost to make one unit of product is $7.35.

- Variances are common in budgeting, but you can have a variance in anything that you forecast.

- Variance analysis can be summarized as an analysis of the difference between planned and actual numbers.

- For any cost that companies can establish a standard, they can also calculate variance analysis.

- An unfavorable labor quantity variance occurred because the actual hours worked to make the 10,000 units were greater than the expected hours to make that many units.

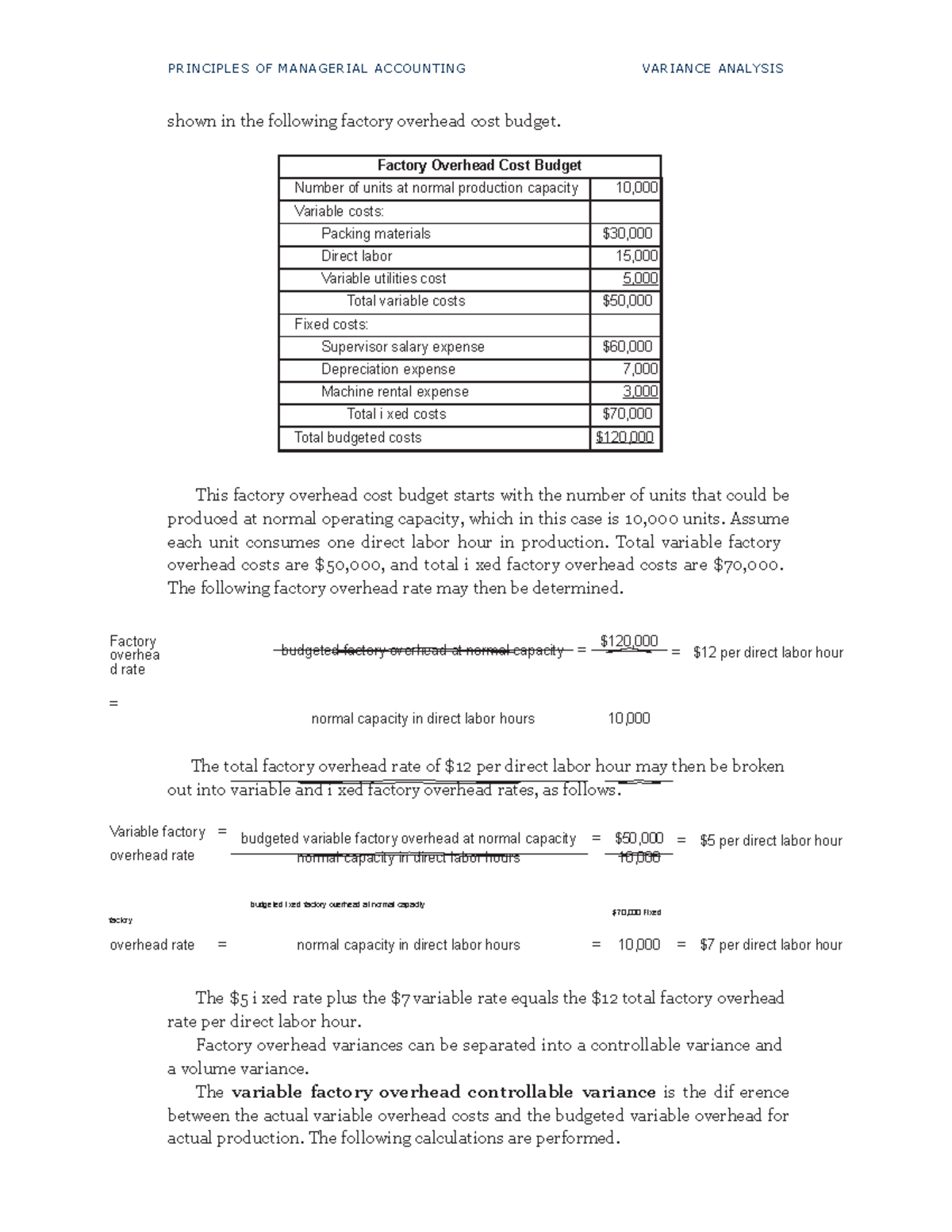

The concept of variance refers to tracking differences between budgeted and actual income or expenses and their effects on an entity’s performance. Variance reporting is employed to control a corporation effectively and eliminate inefficiencies. It offers insights into how successfully a company reaches its goals or expectations, making it a useful tool for monitoring and evaluating financial performance. Before looking closer at these variances, it is first necessary to recall that overhead is usually applied based on a predetermined rate, such as $X per direct labor hour.

This formula applies to different variances, such as labor, pricing, or material usage. The variance is determined by subtracting the actual amount from the forecasted amount. It entails evaluating outcomes in light of prior performance data, industry benchmarks, and best practices to thoroughly assess a company’s success. It can identify areas for improvement or excellence at several levels, including projects, divisions, product lines, or the entire organization. But after breaking down the variances, you notice that your revenue is greater than predicted, but you spent more on materials than anticipated. Using this information, you can shop around for new vendors and cut down unnecessary expenses.

He estimates that each unit should require 4.2 feet of flat nylon cord that costs $0.50 per foot for total direct material costs per unit of $2.10. Each unit should require 0.25 direct labor hours to assemble at an average rate of $18 per hour for total direct labor costs of $4.50 per unit. Variable manufacturing overhead costs are applied to the product based on direct labor hours. The standard variable manufacturing overhead rate is $3 per direct labor hour. Each unit should require 0.25 direct labor hours for total variable manufacturing overhead costs per unit of $0.75. It is important to note that cost standards are established before the work is started.

Cost accounting usually includes establishing costs or analyzing them. For all profit-making companies, cost accounting plays a significant role in profitability. There are several areas of cost accounting, one of which includes standard intangible asset costing. Standard costing is a concept that has existed for a long time and is crucial for companies. This can occur when the standards are improperly established, causing significant differences between actual and standard numbers.

Managers sometimes focus only on making numbers for the current period. For example, a manager might decide to make a manufacturing division’s results look profitable in the short term at the expense of reaching the organization’s long-term goals. A recognizable cost variance could be an increase in repair costs as a percentage of sales on an increasing basis. This variance could indicate that equipment is not operating efficiently and is increasing overall cost. However, the expense of implementing new, more efficient equipment might be higher than repairing the current equipment. A manager needs to be cognizant of his or her organization’s goals when making decisions based on variance analysis.

Therefore, the performance of each responsibility centre is measured and evaluated against budgetary standards with respect to only those areas which are within their direct control. Connie’s Candy used fewer direct labor hours and less variable overhead to produce \(1,000\) candy boxes (units). Variance analysis is a process that companies use to calculate the differences between budgets and actual performances. These include establishing a standard first, which is a part of standard costing. Variance analysis in management accounting is significantly helpful for controlling and monitoring purposes. Companies may also use variance analysis to calculate differences between fixed overhead expenses.