While both IAS 2 and ASC 330 share similar objectives, certain differences exist in the measurement and disclosure requirements that can affect comparability. Here we summarize what we see as the top 10 differences in measurement of inventories under IFRS Standards and US GAAP. Commercial samples, returnable packaging or equipment spare parts typically do not meet the definition of inventories, although these might be managed using the inventory system for practical reasons.

Presentation of Losses from Net Realizable Value

By incorporating NRV, businesses can maintain compliance with accounting standards, make informed decisions, and provide stakeholders with a realistic view of their financial health. Despite its advantages, calculating NRV can be complex and time-consuming, requiring precise estimates and regular adjustments due to market fluctuations. These examples show how NRV helps businesses determine the actual value they can expect from their assets, whether it’s inventory or accounts receivable. By applying NRV calculations, companies can ensure their financial statements reflect a more accurate and realistic financial position. This is the meaning of an accounts receivable balance presented according to U.S. Actual receipts are expected to be close enough to $4.731 billion so that an interested party can rely on this number in arriving at considered decisions about the reporting company’s financial health and future prospects.

Accounts Receivable

Because of various uncertainties, many of the figures reported in a set of financial statements represent estimations. Accounts receivable is shown at its net realizable value, the amount of cash expected to be collected. Losses from bad accounts are anticipated and removed based on historical trends and other relevant information.

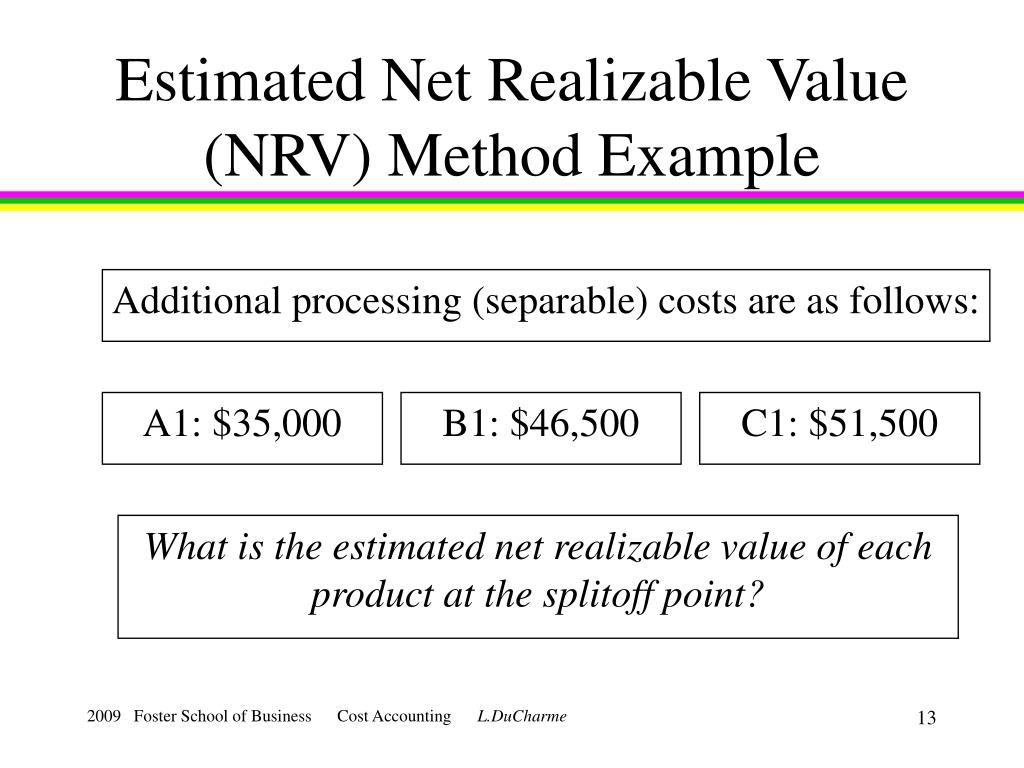

IAS 2 generally measures inventories at the lower of cost and NRV; US GAAP does not

This figure is closely tied to the transaction analysis and accounting equation what is transaction analysis video and lesson transcript, however, the disadvantages include reliance on assumptions about future sales, which can be speculative. NRV is a common method used to evaluate an asset’s value for inventory accounting. Two of the largest assets that a company may list on a balance sheet are accounts receivable and inventory. NRV is a valuation method used in both generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS).

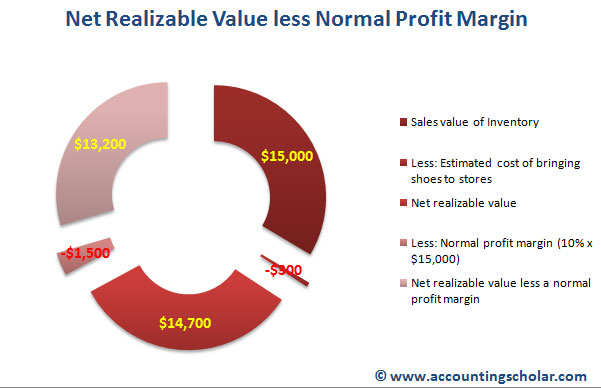

Based on this figure obtained, the firms determine the value of their asset. There are a few steps involved in calculating the net realizable value for an asset. First, you’ll have to determine the expected selling price or the market value. Keep in mind that this should follow the conservatism principle in accounting. Net realizable value is a critical concept in accounting, used to ensure that the value of assets on financial statements is not overstated. Here, we explore the application of NRV in different accounting contexts, including inventory valuation, accounts receivable, and cost accounting.

Step one: Determine the asset values.

The ultimate goal of NRV is to recognize how much proceeds from the sale of inventory or receipt of accounts receivable will actually be received. This relates to the creditworthiness of the clients a business chooses to engage in business with. Companies that prioritize customers with higher credit strength will have higher NRV. NRV is a conservative method for valuing assets because it estimates the true amount the seller would receive net of costs if the asset were to be sold. GAAP requires that certified public accountants (CPAs) apply the principle of conservatism to their accounting work.

- Entities shall not measure physical inventories at fair value, except as provided by guidance in other Topics.

- To properly report the sale, Star Company is determining the net realizable value for the inventory they’re selling.

- The actual total of receivables was higher than that figure but an estimated amount of doubtful accounts had been subtracted in recognition that a portion of these debts could never be collected.

- In the following year, the market value of the green widget declines to $115.

- Within market method accounting, NRV is only used as an approximation of market value when the market value of inventory is unknown.

Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients. KPMG has market-leading alliances with many of the world’s leading software and services vendors. Dummies has always stood for taking on complex concepts and making them easy to understand.

Reversals of writedowns are recognized in profit or loss in the period in which the reversal occurs. US GAAP does not provide specific guidance around accounting for assets that are rented out and then subsequently sold on a routine basis, and practice may vary. Proceeds from the sale would be accounted for in a manner consistent with the nature of the asset, which may be different from IFRS Standards.

To ascertain this figure, you might scrutinize historical sales data, consider current market trends, and evaluate the condition and usability of the asset. It’s also important to account for market saturation or scarcity, which can influence price expectations. When employing the net realizable value method, it’s crucial to consider not only the historical data but also the potential for market changes that could affect the selling price, thus reflecting one of the method’s potential disadvantages. The expected selling price is calculated as the number of units produced multiplied by the unit selling price.